Printable Form W2

Get NowThe Ease of Printable IRS W2 Form Completing

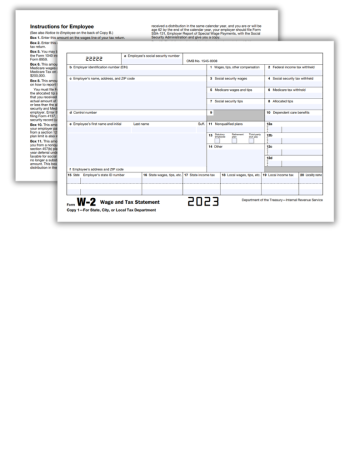

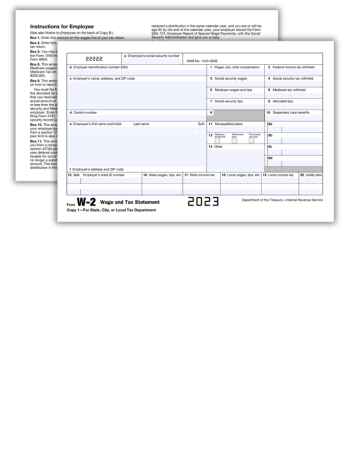

If you are an employer, preparing and submitting Form W-2 for your employees is an essential process. Stay informed and save time with this comprehensive guide to understanding and accurately preparing the W-2 form for the 2023 printable. Below, we'll walk you through the vital aspects of the statement, followed by step-by-step guidance on filling it out and submitting it to the right department within the prescribed deadline.

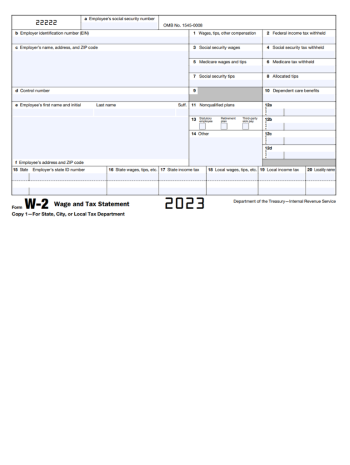

Breaking Down the Blank W-2 Form Layout

At first glance, the printable Form W2 might seem complicated, with various boxes and sections to complete. However, as we break down the main fields, you will see that it is quite simple to fill out. Once you understand this process, you can easily prepare and submit the IRS Form W-2 printable with confidence.

Some critical fields in the printable blank W2 form include.

| Boxes A-F | These boxes contain basic identifying information about the employer and employee, such as name, address, and Social Security Number. |

| Box 1 | Wages, tips, and other compensation. |

| Box 2 | Federal income tax withheld. |

| Box 3 | Social security wages. |

| Box 4 | Social security tax withheld. |

| Box 5 | Medicare wages and tips. |

| Box 6 | Medicare tax withheld. |

| Box 7 | Medicare tax withheld. |

| Box 8 | Nonqualified plans and tips not subject to social security tax. |

| Box 9 | Allocated tips. |

| Box 10 | Blank for future use. |

| Box 11 | Dependent care benefits. |

| Box 12 | Nonqualified benefit plans. |

| Box 13 | Codes and amounts related to certain benefits, plans, or tax-related items. |

| Box 14 | Three checkboxes (statutory employee, retirement plan, and third-party sick pay). |

| Box 15 | The customizable field for any other information the employer wishes to report. |

| Box 16-20 | State and local tax information, if applicable. |

Guide for Completing Your Printable IRS W-2 Form

With this bulleted roadmap, you can seamlessly fill in your W-2 form and prevent any errors:

- Gather necessary information for the employer and employee, including names, Social Security numbers, and addresses.

- Calculate total wages, tips, and other compensation received by the employee during the tax year.

- Determine the amounts of federal, social security, and Medicare taxes withheld from the employee's paycheck throughout the tax year.

- Prepare any necessary information about nonqualified plans, fringe benefits, or other tax-related items that may need to be included in the statement.

- Verify the accuracy of the data and ensure that all applicable boxes are filled out.

- Retain a copy of the finalized document for your records and provide copies to employees as needed.

Submitting Your W-2 Form in 2023: The Ultimate Guide

Once your completed W-2 form is accurate, it's time to submit it. The following steps provide a clear process for a successful submission:

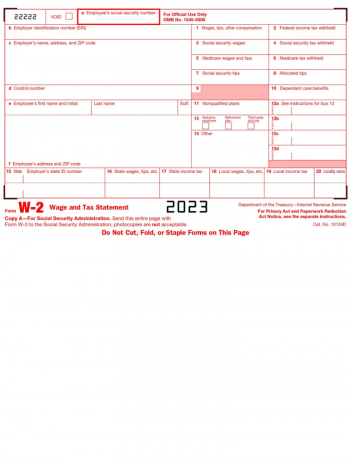

- Prepare all copies of the W-2 form, including

- Copy A (for the Social Security Administration),

- Copy B (for the employee), Copy C (for the employee's records),

- Copy D (for your records), and any additional copies required by your state.

- Review any digital filing options available, which can save time and streamline the process.

- Submit a copy of your W-2 form to the Social Security Administration, either electronically or by postal mail, depending on your preference and business requirements.

- Ensure the employee receives their copies of the completed W-2 form, either directly or through a secure electronic method.

Act Now: W-2 Form Submission Deadline

Remember, Form W-2 is due to the Social Security Administration and your employees by January 31, 2023. Don't wait until the last minute! As you gain familiarity with the process and the statement layout, completing and submitting your W-2 form will become increasingly manageable. Save time and reduce stress by diligently preparing your W-2 form before the deadline.

Related Forms

-

![image]() W-2 The IRS Form W-2 is a crucial document that tells people how much money they made in a year at their job and the amount that was taken out for taxes and other required payments. It's like a report card for grown-ups to see what they did for work and money during the year. This statement comes from your job, and you need it to fill out another tax form called 1040. Fill Now

W-2 The IRS Form W-2 is a crucial document that tells people how much money they made in a year at their job and the amount that was taken out for taxes and other required payments. It's like a report card for grown-ups to see what they did for work and money during the year. This statement comes from your job, and you need it to fill out another tax form called 1040. Fill Now -

![image]() Federal W-2 Form W2 federal income tax form is an essential document for millions of taxpayers throughout the United States. It might be overwhelming for some, but understanding its significance and how it works can severely impact your annual returns. Let's dive into understanding the nuts and bolts of this critical document. A Quick Tour of the W2 Form's Origins Hailing back to 1944, Form W-2 has been a staple in the tax filing process. Primarily, employers use this form to report the overall salary, tax deductions, and other income-related information about their employees to the Internal Revenue Service (IRS) and the Social Security Administration (SSA). By providing a detailed account of your financial year, the W-2 is a valuable resource for determining your tax liability and preparing your annual income return. Recent Changes: Keeping Up with the Times While the fundamental purpose remains the same, the federal tax form W-2 has experienced some revisions in recent years. Notably, the 2022 federal W2 form incorporated adjustments to the form's design and layout, improving the clarity of income and tax-related information for both employers and employees. In addition, the form now includes specific codes for reporting employee COVID-19 leave pay and tax credits as part of the government's pandemic response. It's essential to stay informed about these modifications, as they may affect your tax filing process. Determining If Form W-2 Applies to You The federal W-2 form for 2023 is relevant to countless hardworking individuals across the nation. You'll likely need to use this form if you are an employee who had income tax, Social Security, or Medicare taxes withheld from your paycheck during the fiscal year. However, some scenarios do not require a Form W-2. For instance, self-employed individuals and independent contractors will not typically receive a W-2 form from their clients, as they use other forms (such as 1099-NEC) to report their income and expenses. If you're unsure about which IRS document applies to you, consult the professional for clarification. Tips for Utilizing Form W-2 Now that you've got a grip on the federal form W-2 2022 and its role in your annual income returns, let's explore some strategies to maximize its benefits: Review it thoroughlyAnalyzing every field and checking for possible mistakes is crucial, as errors can lead to difficulties in filing your taxes or delaying your tax refund. Keep a copyRetaining a personal copy of your W-2 copy allows you to manage and plan your tax deductions efficiently, ensuring you make the most out of your hard-earned money. Organize financial recordsIn addition to the W-2 copy, it's helpful to collect other tax-related documents such as receipts for donations or business expenses, to make the statement filing process as seamless and stress-free as possible. Seek professional helpIf you're unsure about how to interpret your W-2 or have any questions about your tax situation, don't hesitate to engage a reputable tax professional to ensure compliance and optimize your tax return. Understanding and utilizing your Form W-2 effectively is critical for a smooth statement filing experience. Armed with this knowledge, you can now move forward confidently, knowing you have the tools to optimize your financial strategy and make your money work for you. Fill Now

Federal W-2 Form W2 federal income tax form is an essential document for millions of taxpayers throughout the United States. It might be overwhelming for some, but understanding its significance and how it works can severely impact your annual returns. Let's dive into understanding the nuts and bolts of this critical document. A Quick Tour of the W2 Form's Origins Hailing back to 1944, Form W-2 has been a staple in the tax filing process. Primarily, employers use this form to report the overall salary, tax deductions, and other income-related information about their employees to the Internal Revenue Service (IRS) and the Social Security Administration (SSA). By providing a detailed account of your financial year, the W-2 is a valuable resource for determining your tax liability and preparing your annual income return. Recent Changes: Keeping Up with the Times While the fundamental purpose remains the same, the federal tax form W-2 has experienced some revisions in recent years. Notably, the 2022 federal W2 form incorporated adjustments to the form's design and layout, improving the clarity of income and tax-related information for both employers and employees. In addition, the form now includes specific codes for reporting employee COVID-19 leave pay and tax credits as part of the government's pandemic response. It's essential to stay informed about these modifications, as they may affect your tax filing process. Determining If Form W-2 Applies to You The federal W-2 form for 2023 is relevant to countless hardworking individuals across the nation. You'll likely need to use this form if you are an employee who had income tax, Social Security, or Medicare taxes withheld from your paycheck during the fiscal year. However, some scenarios do not require a Form W-2. For instance, self-employed individuals and independent contractors will not typically receive a W-2 form from their clients, as they use other forms (such as 1099-NEC) to report their income and expenses. If you're unsure about which IRS document applies to you, consult the professional for clarification. Tips for Utilizing Form W-2 Now that you've got a grip on the federal form W-2 2022 and its role in your annual income returns, let's explore some strategies to maximize its benefits: Review it thoroughlyAnalyzing every field and checking for possible mistakes is crucial, as errors can lead to difficulties in filing your taxes or delaying your tax refund. Keep a copyRetaining a personal copy of your W-2 copy allows you to manage and plan your tax deductions efficiently, ensuring you make the most out of your hard-earned money. Organize financial recordsIn addition to the W-2 copy, it's helpful to collect other tax-related documents such as receipts for donations or business expenses, to make the statement filing process as seamless and stress-free as possible. Seek professional helpIf you're unsure about how to interpret your W-2 or have any questions about your tax situation, don't hesitate to engage a reputable tax professional to ensure compliance and optimize your tax return. Understanding and utilizing your Form W-2 effectively is critical for a smooth statement filing experience. Armed with this knowledge, you can now move forward confidently, knowing you have the tools to optimize your financial strategy and make your money work for you. Fill Now -

![image]() Blank W-2 Form for 2023 Dealing with tax forms can be daunting, especially when you're unsure of their purpose or how to use them correctly. Fortunately, we're here to help you navigate these important documents. Let's start by unraveling the mysteries of the blank W2 form template. It's an essential tax form issued by employers to their employees for the purpose of reporting annual wages and taxes withheld from their paychecks. Employers are required to distribute the blank W-2 form for 2022 printable to their employees and also submit them to the IRS. This statement plays a vital role for employees as they need the information provided on the statement to complete their individual income tax returns. Now that we know its purpose, let's dive into who can't use this document. Non-Eligibility for the IRS Form W-2 While most employees will receive a W-2 blank form from their employers, there are certain individuals who will not. These include independent contractors, freelancers, and self-employed individuals who typically receive a 1099 copy instead of a W-2. If you fall into one of these categories, you'll need to report your income and expenses on different tax forms. Demonstrating the Usefulness of Form W-2 Let's say Jane Doe works as a full-time employee for ABC Company. At the end of the year, her employer provides her with a free printable blank W-2 form detailing her annual wages, tips, and other compensation, along with the total amount of federal, state, and local taxes withheld from her paycheck. Jane then uses this information to file her individual income tax return, ensuring that she pays the accurate amount of taxes or receives a well-deserved refund. Without the W-2 sample, Jane could risk miscalculating her tax obligations and face potential penalties. Common Issues with IRS Form W-2 and their Solutions Issue Solution Lost or incorrect W-2 form Contact your employer to obtain a duplicate sample, or request a correction for errors. If a duplicate is unavailable, you may use the 4852 copy as a substitute. Missing Social Security number (SSN) or incorrect information Immediately inform your employer and request a corrected W-2 sample. Employer withheld less taxes than required Ask your employer to correct the issue. If unresolved, consult a tax professional or report the issue to the IRS. Non-receipt of W-2 form by the filing deadline Contact your employer to ensure they've mailed the copy. If unavailable, use Form 4852 as a substitute, or seek assistance from the IRS. The blank W-2 tax form is an indispensable document for employers and employees. It provides crucial information for accurately filing your tax returns, and knowing how to address common issues empowers you to stay ahead of any potential tax problems. Fill Now

Blank W-2 Form for 2023 Dealing with tax forms can be daunting, especially when you're unsure of their purpose or how to use them correctly. Fortunately, we're here to help you navigate these important documents. Let's start by unraveling the mysteries of the blank W2 form template. It's an essential tax form issued by employers to their employees for the purpose of reporting annual wages and taxes withheld from their paychecks. Employers are required to distribute the blank W-2 form for 2022 printable to their employees and also submit them to the IRS. This statement plays a vital role for employees as they need the information provided on the statement to complete their individual income tax returns. Now that we know its purpose, let's dive into who can't use this document. Non-Eligibility for the IRS Form W-2 While most employees will receive a W-2 blank form from their employers, there are certain individuals who will not. These include independent contractors, freelancers, and self-employed individuals who typically receive a 1099 copy instead of a W-2. If you fall into one of these categories, you'll need to report your income and expenses on different tax forms. Demonstrating the Usefulness of Form W-2 Let's say Jane Doe works as a full-time employee for ABC Company. At the end of the year, her employer provides her with a free printable blank W-2 form detailing her annual wages, tips, and other compensation, along with the total amount of federal, state, and local taxes withheld from her paycheck. Jane then uses this information to file her individual income tax return, ensuring that she pays the accurate amount of taxes or receives a well-deserved refund. Without the W-2 sample, Jane could risk miscalculating her tax obligations and face potential penalties. Common Issues with IRS Form W-2 and their Solutions Issue Solution Lost or incorrect W-2 form Contact your employer to obtain a duplicate sample, or request a correction for errors. If a duplicate is unavailable, you may use the 4852 copy as a substitute. Missing Social Security number (SSN) or incorrect information Immediately inform your employer and request a corrected W-2 sample. Employer withheld less taxes than required Ask your employer to correct the issue. If unresolved, consult a tax professional or report the issue to the IRS. Non-receipt of W-2 form by the filing deadline Contact your employer to ensure they've mailed the copy. If unavailable, use Form 4852 as a substitute, or seek assistance from the IRS. The blank W-2 tax form is an indispensable document for employers and employees. It provides crucial information for accurately filing your tax returns, and knowing how to address common issues empowers you to stay ahead of any potential tax problems. Fill Now -

![image]() W-2 Tax Form Understanding IRS forms can feel overwhelming, especially when your tax situation isn't straightforward. If you're one of those who need to submit a W-2 tax form, you may find yourself dealing with unique circumstances. Don't worry - we've got you covered. In this guide, we'll dive into some unconventional scenarios, explore solutions, and give you peace of mind that your taxes are in order. IRS Form W-2 in Tricky Situations Imagine receiving a W2 tax form for print, only to discover you've been hired as an independent contractor instead of an employee. This could leave you with confusion as to whether you should submit a W-2 tax form or a 1099 template. The answer is simple: If you're an employee, use the W-2 tax form PDF. If you're an independent contractor, the 1099 is your go-to sample. Before submitting your tax return, double-check your employment status to avoid any issues with the IRS. Next, let's explore what to do if you're an employee who has multiple employers throughout the year. You'll likely receive a separate blank W-2 tax form from each employer. Don't fret! You'll need to submit all these forms (not the blank ones) with your tax return to ensure accurate reporting of your income and taxes withheld. Finally, suppose you're an international employee who received a W-2 but didn't live in the United States during the entire tax year. You'll need to report your worldwide income on the IRS W2 tax form for 2023. Remember, though, that you may be able to exclude a portion of your foreign income or claim a tax-related credit. Consult with a financial professional experienced in international tax issues to ensure you're in compliance. Errors on Your Submitted Tax Form W-2 Eagle-eyed taxpayers may spot mistakes after submitting their printable W2 tax forms. Don't panic! You can rectify errors through the following steps: Get a printable Form W-2c. Complete the W-2c template with the correct information. Submit the corrected statement to your employer, who will forward it to the IRS. If you only spot the error after receiving your refund or notice from the IRS, you may need to amend your annual return using Form 1040-X. Always consult with a financial advisor to determine if this is necessary in your case. Form W-2 FAQs: Straight Answers to Your Top Queries What if I haven't received my W-2? Reach out to your employer to confirm they have your correct address. If you still don't get the document after contacting your employer, call the IRS for assistance. How do I file my taxes without a W-2? If you don’t receive your W-2 by the due date, you can use Form 4852 to file your tax return. However, it's crucial to make every effort to obtain your W-2 before resorting to this option. What should I do if I realize I made a mistake after filing the W-2?Use the guide above. Obtain and complete the W-2c application and submit it to your employer, who will then forward it to the IRS. If the mistake affects your income return, you may need to file an amended return using Form 1040-X. Now you're armed with knowledge about unusual tax-related situations, how to correct errors, and answers to some common Form W-2 questions. Remember to consult with the IRS professional for guidance specific to your current situation for the best results. Fill Now

W-2 Tax Form Understanding IRS forms can feel overwhelming, especially when your tax situation isn't straightforward. If you're one of those who need to submit a W-2 tax form, you may find yourself dealing with unique circumstances. Don't worry - we've got you covered. In this guide, we'll dive into some unconventional scenarios, explore solutions, and give you peace of mind that your taxes are in order. IRS Form W-2 in Tricky Situations Imagine receiving a W2 tax form for print, only to discover you've been hired as an independent contractor instead of an employee. This could leave you with confusion as to whether you should submit a W-2 tax form or a 1099 template. The answer is simple: If you're an employee, use the W-2 tax form PDF. If you're an independent contractor, the 1099 is your go-to sample. Before submitting your tax return, double-check your employment status to avoid any issues with the IRS. Next, let's explore what to do if you're an employee who has multiple employers throughout the year. You'll likely receive a separate blank W-2 tax form from each employer. Don't fret! You'll need to submit all these forms (not the blank ones) with your tax return to ensure accurate reporting of your income and taxes withheld. Finally, suppose you're an international employee who received a W-2 but didn't live in the United States during the entire tax year. You'll need to report your worldwide income on the IRS W2 tax form for 2023. Remember, though, that you may be able to exclude a portion of your foreign income or claim a tax-related credit. Consult with a financial professional experienced in international tax issues to ensure you're in compliance. Errors on Your Submitted Tax Form W-2 Eagle-eyed taxpayers may spot mistakes after submitting their printable W2 tax forms. Don't panic! You can rectify errors through the following steps: Get a printable Form W-2c. Complete the W-2c template with the correct information. Submit the corrected statement to your employer, who will forward it to the IRS. If you only spot the error after receiving your refund or notice from the IRS, you may need to amend your annual return using Form 1040-X. Always consult with a financial advisor to determine if this is necessary in your case. Form W-2 FAQs: Straight Answers to Your Top Queries What if I haven't received my W-2? Reach out to your employer to confirm they have your correct address. If you still don't get the document after contacting your employer, call the IRS for assistance. How do I file my taxes without a W-2? If you don’t receive your W-2 by the due date, you can use Form 4852 to file your tax return. However, it's crucial to make every effort to obtain your W-2 before resorting to this option. What should I do if I realize I made a mistake after filing the W-2?Use the guide above. Obtain and complete the W-2c application and submit it to your employer, who will then forward it to the IRS. If the mistake affects your income return, you may need to file an amended return using Form 1040-X. Now you're armed with knowledge about unusual tax-related situations, how to correct errors, and answers to some common Form W-2 questions. Remember to consult with the IRS professional for guidance specific to your current situation for the best results. Fill Now -

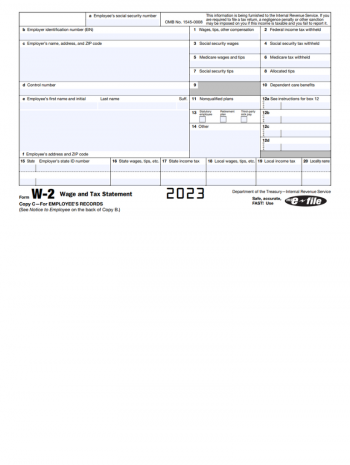

![image]() W2 Form for 2023 in PDF Every tax season, millions of Americans diligently prepare their income returns to report their earnings to the IRS. Among the essential documents to fill out is the W-2 tax form PDF, which serves to report an individual's wages and tax-related withholdings. This powerful tax document often leaves taxpayers scratching their heads when it comes to the various W-2 copies. But worry not! This article will provide a comprehensive overview of each copy, their purpose, who needs to use them, and what to do if you forget to submit one. Plus, we'll address the top three popular questions related to W-2 forms. IRS Form W-2: The Ultimate Tax Document for Employees Before delving into the individual copies, understanding the purpose of the W2 form is crucial. This form is issued by an employer to their employees who have received wages or salary during the tax year. The purpose of the fillable W-2 form PDF is to both help employees file their tax returns and keep the IRS informed about the employee's earnings and withholdings. The information on the form, such as wages and tax withholdings, is broken down into several categories, including federal, state, and local income tax information. W-2 Form Copies: A Breakdown of Each Copy and Its Purpose A — This copy is generally submitted by the employer to the Social Security Administration (SSA) along with a completed Form W-3. It contains essential information such as the employee's wages, taxes withheld, and Social Security and Medicare contributions. B — This one is for the employee's federal tax return. The employee should attach this copy to their federal income tax return when filing with the IRS. C — Labeled as an "Employee Record," copy C is for the employee to keep for their own personal records. D — This is an extra copy for the employer to keep in their files. Employers should retain this copy for at least four years to comply with federal recordkeeping requirements. 1 — To be filed with the appropriate state, city, or local tax department, copy 1 is required for tax reporting purposes at the state or local levels. 2 — Similarly, this copy is for the employee to submit with their state, city, or local income tax return. What to Do If You Forget a W-2 Form Copy If a W-2 form copy is lost or forgotten, don't panic! First, try to contact your employer and request a duplicate of the missing or lost copy. If that's not possible, you can always download a blank W2 form PDF and manually fill it out with the necessary information. For the tax year 2022, be sure to search for the 2023 W2 form PDF. Top 3 Popular Questions about W-2 Forms When should I receive my W-2 form from my employer?Employers are required to provide W-2 forms to employees by January 31st of each year. If you haven't received it by that date, contact your employer to ensure they have your correct mailing address. What if I worked for multiple employers?If you worked for multiple employers during the tax year, you should receive a separate copy from each employer. Be sure to include information from all W-2 forms when filing your annual return. Can I file my taxes without a W-2 form?Although waiting for your W-2 form to arrive before filing is recommended, you can file your taxes using the 4852 example if you haven't received your wage statement template by the return filing deadline. Understanding and handling your W-2 form copies is crucial for accurate and successful tax filing. Ensure to familiarize yourself with each copy's purpose and remember to check for the correct year when searching for downloadable W-2 forms. Fill Now

W2 Form for 2023 in PDF Every tax season, millions of Americans diligently prepare their income returns to report their earnings to the IRS. Among the essential documents to fill out is the W-2 tax form PDF, which serves to report an individual's wages and tax-related withholdings. This powerful tax document often leaves taxpayers scratching their heads when it comes to the various W-2 copies. But worry not! This article will provide a comprehensive overview of each copy, their purpose, who needs to use them, and what to do if you forget to submit one. Plus, we'll address the top three popular questions related to W-2 forms. IRS Form W-2: The Ultimate Tax Document for Employees Before delving into the individual copies, understanding the purpose of the W2 form is crucial. This form is issued by an employer to their employees who have received wages or salary during the tax year. The purpose of the fillable W-2 form PDF is to both help employees file their tax returns and keep the IRS informed about the employee's earnings and withholdings. The information on the form, such as wages and tax withholdings, is broken down into several categories, including federal, state, and local income tax information. W-2 Form Copies: A Breakdown of Each Copy and Its Purpose A — This copy is generally submitted by the employer to the Social Security Administration (SSA) along with a completed Form W-3. It contains essential information such as the employee's wages, taxes withheld, and Social Security and Medicare contributions. B — This one is for the employee's federal tax return. The employee should attach this copy to their federal income tax return when filing with the IRS. C — Labeled as an "Employee Record," copy C is for the employee to keep for their own personal records. D — This is an extra copy for the employer to keep in their files. Employers should retain this copy for at least four years to comply with federal recordkeeping requirements. 1 — To be filed with the appropriate state, city, or local tax department, copy 1 is required for tax reporting purposes at the state or local levels. 2 — Similarly, this copy is for the employee to submit with their state, city, or local income tax return. What to Do If You Forget a W-2 Form Copy If a W-2 form copy is lost or forgotten, don't panic! First, try to contact your employer and request a duplicate of the missing or lost copy. If that's not possible, you can always download a blank W2 form PDF and manually fill it out with the necessary information. For the tax year 2022, be sure to search for the 2023 W2 form PDF. Top 3 Popular Questions about W-2 Forms When should I receive my W-2 form from my employer?Employers are required to provide W-2 forms to employees by January 31st of each year. If you haven't received it by that date, contact your employer to ensure they have your correct mailing address. What if I worked for multiple employers?If you worked for multiple employers during the tax year, you should receive a separate copy from each employer. Be sure to include information from all W-2 forms when filing your annual return. Can I file my taxes without a W-2 form?Although waiting for your W-2 form to arrive before filing is recommended, you can file your taxes using the 4852 example if you haven't received your wage statement template by the return filing deadline. Understanding and handling your W-2 form copies is crucial for accurate and successful tax filing. Ensure to familiarize yourself with each copy's purpose and remember to check for the correct year when searching for downloadable W-2 forms. Fill Now